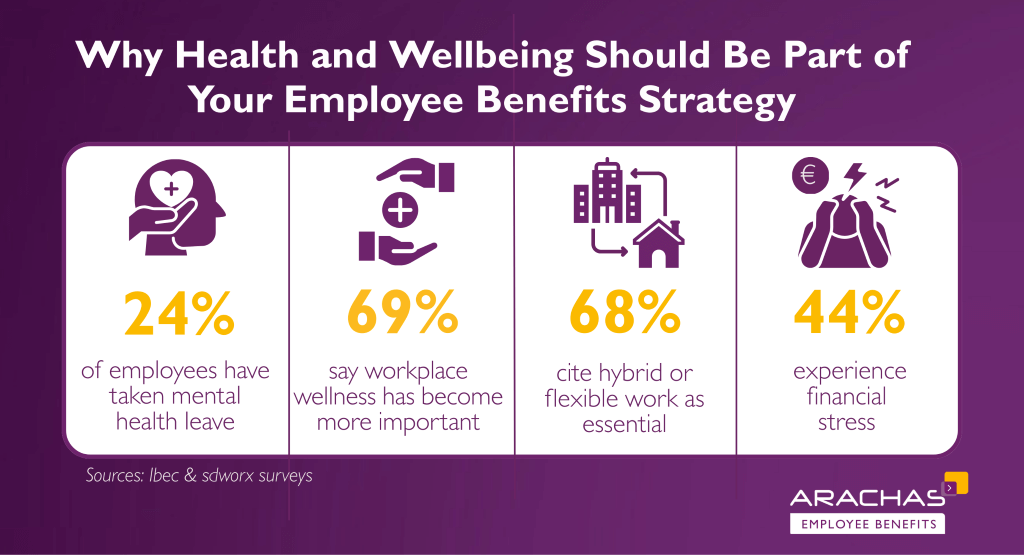

Employee wellbeing has moved from a “nice to have” to a business-critical priority in Ireland. Organisations are recognising that wellbeing impacts engagement, retention and productivity. According to Ibec’s Workplace Wellness research, 69% of employees say workplace wellness has become more important in recent years and 68% cite hybrid or flexible work as essential to their wellbeing. Many will even trade pay for flexibility, with 35% saying they would leave a well-paid role for better hybrid options. This signals that flexibility is no longer just a perk, it is a core expectation.

The Business Case: Why Wellbeing Matters

Wellbeing is not just about doing the right thing for employees. It is about performance and risk management. CIPD’s HR Practices in Ireland 2025 report shows that 51% of organisations now have wellbeing on the senior leadership agenda, and 36% report it has become more challenging to manage. Mental health was identified as being one of the leading causes of absence in 25% of organisations. Acute medical conditions were only fractionally higher at 26%. SD Worx research highlights that almost one in four Irish employees has taken mental health leave, compared to an EU average of 18%. These figures underline the cost of inaction and the need for proactive strategies.

What Employers Are Offering

Irish employers are responding with a mix of benefits. CIPD Ireland data and industry research show:

- Group Pensions: Around half of employers offer an occupational pension scheme. These schemes are almost universal among larger organisations. With the introduction of pension auto-enrolment this month, more SMEs are considering setting up company pension schemes as a more flexible and in many areas, attractive option, to attract and retain employees.

- Group Life assurance and income protection: Frequently included in packages for medium and large employers.

- Private medical insurance: Offered by many larger organisations and overall 46% of the Irish population has private health insurance. Many employees also take advantage of company-negotiated discounts and schemes offered by health insurers.

- Wellbeing initiatives: CIPD reports that 56% of organisations provide online wellbeing initiatives and 54% are increasing investment in mental health support.

These numbers show that while financial benefits remain the foundation, health and wellbeing supports are becoming standard practice.

Mental Health: From Awareness to Action

Employers increasingly recognise their responsibility. UCC’s Healthy Workplace Ireland report found that 76% of employers agree they are responsible for employee mental health (81% agree in larger firms), but only 20% have a dedicated budget to support employees mental health and just 32% have a wellbeing lead at board level. This gap between intention and investment is significant. Without resources, even the best intentions cannot deliver impact. Practical steps such as employee assistance programmes, counselling services and mental health champions can make a real difference.

Culture matters too. CIPD research shows that half of organisations encourage employees to disconnect after hours, which helps tackle burnout and supports healthier work-life balance. SD Worx also reports that 50% of employees describe their work as mentally demanding or stressful, and 29% say their job negatively affects their mental health. These findings show that mental health challenges are not just personal—they are organisational issues.

Financial Wellbeing: The Overlooked Factor

Financial stress often goes unnoticed, yet it significantly affects performance and mental health. Research from SD Worx shows that 44% of employees in Ireland experience financial stress, and Ibec reports that 41% of HR leaders identify financial wellbeing as a top challenge for the year ahead.

Employers can make a real difference by offering financial education, budgeting tools and pension guidance. These supports help employees feel more secure and reduce stress that can spill over into work.

The Regulatory Imperative: CSRD in Ireland

Wellbeing is no longer just a competitive advantage – it’s becoming a compliance requirement. Ireland has transposed the EU Corporate Sustainability Reporting Directive (CSRD) into law, introducing phased obligations for companies to report on workforce wellbeing metrics as part of ESG disclosures.

Large companies, public-interest entities and non-EU organisations with a significant EU presence will need to provide detailed data on areas such as health, safety and mental wellbeing. While CSRD may not explicitly mandate a wellbeing strategy, the depth of reporting required will, in practice, push companies to implement structured wellbeing initiatives.

When reviewing your employee benefits, it’s worth considering these requirements and whether your company is in scope. Aligning your benefits with these expectations now will help you stay compliant and strengthen your sustainability approach.

Practical Steps for Irish Employers

1. Audit and Baseline: Review your current benefits, utilisation and absenteeism data.

2. Invest in Mental Health: Provide Employee Assistance Programmes (EAPs), counselling and manager training.

3. Embed Flexibility: Make hybrid work part of your wellbeing approach.

4. Support Financial Wellbeing: Offer budgeting tools and pension advice.

5. Enhance Health Benefits: Consider private medical insurance and wellbeing programmes to support physical and mental health.

The Bottom Line

Wellbeing is now a business priority in Ireland. Employees expect it, leaders are focusing on it and regulators may require it. An Employee Benefits Strategy that puts health, mental health, flexibility and financial resilience at its core along with pensions and protection benefits will help organisations attract and retain talent and build a more engaged and resilient workforce.

If you want to explore how to strengthen your benefits strategy with wellbeing initiatives, pensions and protection, talk to our Employee Benefits team today. Call +353(0)1 7075880 or email [email protected]

SOURCES

· Ibec Workplace Wellness Research (2025) https://www.ibec.ie/connect-and-learn/media/2025/04/14/ibec-launches-new-workplace-wellness-research-ahead-of-national-workplace-wellbeing-day

· CIPD Ireland – HR Practices in Ireland Report (2025) https://www.cipd.org/ie/views-and-insights/thought-leadership/insight/promoting-wellbeing-ireland/

· SD Worx Mental Health Leave Survey (2024) https://www.sdworx.ie/en-ie/about-us/press/irish-employees-mental-health-leave-2024-sd-worx

· UCC Healthy Workplace Ireland Report (2023) https://www.ucc.ie/en/media/mandc/UCCCUBSHealthyWorkplaceIrelandReport_Mar2023.pdf

· Almost half of employees in Ireland suffer from financial stress | SD Worx (2024) https://www.sdworx.ie/en-ie/about-us/press/employees-suffer-financial-stress

· Corporate Sustainability Reporting – DETE https://enterprise.gov.ie/en/what-we-do/the-business-environment/corporate-sustainability-reporting/

Frank Glennon (Life & Pensions) Limited, trading as “Arachas Employee Benefits”, “Arachas Financial Planning”, “Glennon”, “Glennon Employee Benefits” and “Glennon Financial Planning”, is regulated by the Central Bank of Ireland.